Recently, the energy crisis in Europe has frequently been “overwhelming”, Germany has closed escalators, Spain has re-opened the pottery to cool down, and Polish people have queued up to buy coal…

This wave of the European energy crisis has brought huge development space to the household energy storage track. In the eyes of industry insiders, the development of household energy storage can be regarded as a sea of stars.

And behind this sea of stars, there is still a certain “shadow”. According to the analysis of the Advanced Industrial Research Institute (GGII), the household storage market has exploded beyond expectations, and the shortage of batteries has become the biggest bottleneck in the development of the industry in the short and medium term.

The number of companies entering the home storage track has also increased sharply by several times. Most of the companies with early card positions achieved double-enhanced revenue and profitability in the first half of this year.

For example, in the first half of 2022, Paineng Technology achieved an operating income of 1.854 billion yuan, a year-on-year increase of 171.94%, and a net profit of 264 million yuan, a year-on-year increase of 70.02%. In the first half of 2022, Penghui Energy’s operating income was about 4.065 billion yuan, a year-on-year increase of 65.58%, and its net profit was about 244 million yuan, a year-on-year increase of 105.95%. Among them, household energy storage contributed the main increment.

In the short term, household energy storage batteries are an obvious incremental market. Haichen Energy Storage, Penghui Energy, Paineng Technology, etc. have increased their investment in the field of household energy storage. Among them, Penghui Energy and Paineng Technology have set off a wave of cell expansion; while Haichen Energy Storage has released a large cylindrical household energy storage special battery for household energy storage.

1. Household battery manufacturers racing

For household energy storage, the system composed of small cells is very important, which involves key experience such as SOC, BMS skills, software, and charge-discharge balance. Obviously, in the face of the rapidly growing household storage market, the market for small-capacity batteries suitable for household storage does not have enough reserves.

Sungrow, which just released its semi-annual report, also illustrates this point. In the first half of the year, due to the impact of battery cell bottlenecks, only 15,000 battery systems were used for household energy storage.

In order to improve supply capacity, Penghui Energy and Paineng Technology have increased production capacity. In May of this year, Paineng Technology plans to invest 5 billion yuan to build a 10GWh lithium battery R&D and manufacturing base project in Feixi County, Hefei City. After two months (late July), Penghui Energy plans to build an energy storage battery project with an annual output of 20GWh in Quzhou, Zhejiang, with a total investment of about 6 billion yuan.

A 5GWh energy storage battery project will be built, and a 10GWh energy storage battery project will be constructed in the third phase.

In addition to the expansion of battery cell manufacturers, Haichen Energy Storage recently released a large-cylinder special battery for household energy storage. It wants to redefine the special energy storage battery for household energy storage scenarios.

Its cylindrical product specifications cover 4680-46300, the single capacity is 10-50Ah, the flexibility and adaptability are stronger, and it can meet the needs of diversified energy storage application scenarios. It has made great breakthroughs in many aspects such as cost, flexibility, consistency, safety and long life.

2. Heavier product design for household energy storage batteries

Household energy storage, as a small energy storage battery, seems to focus on storage, but subsequent battery management and whole-house energy allocation are equally important. Therefore, the core competitiveness of household energy storage batteries is product design capabilities.

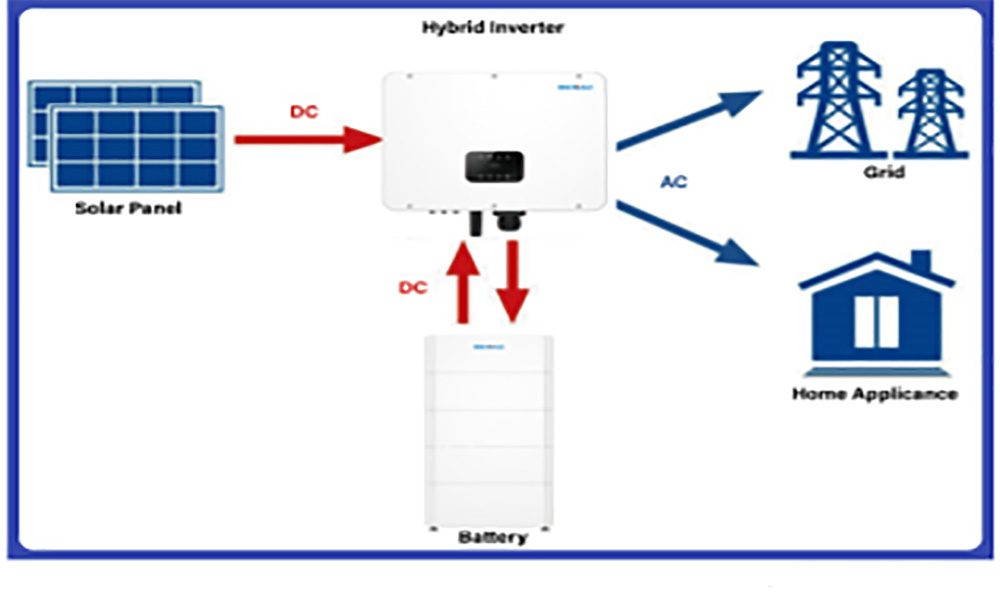

In the design of energy storage battery products, it is mainly the adaptation with energy storage inverters (different countries/regions have different requirements) and customized product design for customer needs.

For example, the BMS (battery management system) in the energy storage system needs to be adapted to the energy storage inverter. The energy storage inverter controller communicates with the BMS through the CAN interface to obtain battery pack status information, which can protect the battery. Charge and discharge to ensure the safe operation of the battery.

Among them, the energy storage BMS should have the function of monitoring the battery voltage, current, and temperature in real-time, and then realize the calculation of the battery status such as SOC and SOH, so as to realize the functions of balance management, thermal management, and fault alarm of the battery.

According to reports, energy storage BMS is different from vehicle BMS, which has higher requirements for adapting to the environment. The energy storage system is more complex and huge, with a deeper charge and discharge depth and a longer life cycle. The energy storage BMS needs to deal with a more complex energy management system.

GGII predicts that by 2025, the value of China’s energy storage BMS market will reach 17.8 billion yuan (including overseas exports), with a compound annual growth rate of 47%.

Paineng Technology, BYD, Penghui Energy, etc., which have a high market share in the international household energy storage battery market, are completely independent research and development and production in key links such as batteries, BMS, and system PACK. In the short term, having a strong battery capacity has obvious advantages in the field of household energy storage.

3. The trend of cost reduction of household energy storage batteries is obvious

Overall, the development trend of household storage batteries is mainly reflected in reducing production costs, reducing the risk of thermal runaway, and improving battery adaptability.

First, increased production efficiency can lead to lower monomer production costs. A typical household energy storage system is generally 5KW (component + inverter) with 10kWh (energy storage battery), of which the battery is the core of the energy storage system, and the cost accounts for about 45-50%. Then the cost reduction of the battery cell is very important for the energy storage system.

Second, improving safety reduces the risk of thermal runaways. At present, most household storage systems lack precise temperature control systems, so there are higher requirements for the safety of the battery itself.

Finally, the smaller single-cell capacity can improve battery adaptability, and the module shape and charge capacity are more diverse.

From the perspective of monomer capacity, household energy storage cells mainly include squares, large cylinders, and soft packs. Among them, the monomer capacity of the large cylinder is 10Ah-50Ah, the square is 50Ah-300Ah, and the soft bag is 30Ah-80Ah.

Smaller cell capacity determines the diversity of cell module formation and module capacity, which can match household storage and portable energy storage systems with different charges. GGII also believes that small-capacity batteries below 100Ah still have a long application life cycle in the field of household storage.

In the increasingly popular household storage high-voltage system, a smaller cell capacity is more suitable. At present, the European household storage market (especially the Nordic + German-speaking region) is undergoing product iteration from low-voltage to high-voltage systems, increasing the voltage platform in order to reduce the current, ultimately reducing the system heat generation and improving the discharge efficiency.

Generally speaking, as the voltage platform rises, to keep the total energy storage system capacity unchanged (home storage systems are usually within 10kwh), the cells need to be made with a small capacity. The energy storage cells of low-voltage platforms are mostly 100Ah, while high-voltage platforms are gradually transitioning to 50Ah (Ningde expects to mass-produce 26Ah products in the second half of the year, and Haichen energy storage large cylindrical cells have achieved 10-50Ah).

In the mid-term financial report exchange meeting of a leading domestic optical storage company, the management also mentioned that the soft power of household energy storage in terms of long-term friendliness with the power grid, matching with household appliances, and adaptation of charging piles is the key , but the supply bottleneck of battery cells in the short and medium term is still the key.